Can You Collect Social Security and a Pension at the Same Time

Introduction to Pension Bookkeeping

In add-on to salaries, many companies offer other benefits to their employees such as pension plans, health insurance, stock option benefits, fitness memberships, or life insurance plans. At that place are very specific requirements around pension bookkeeping, which volition be outlined in this article.

For regular benefits, the accounting is relatively simple – the employer records an expense for the amount of the benefits employees earn in a yr.

Notwithstanding, the bookkeeping treatment becomes more complicated when employees earn the rights to the benefits NOW simply receive those benefits subsequently, in the Futurity. A clear example of such a benefit is the pension.

To learn more, launch CFI'due south online accounting courses at present!

How a Pension Works

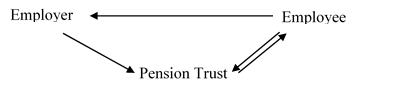

Pension plans are best summarized in a diagram. The following diagram shows three major players: the employer, the employee, and the alimony trust.

A pension trust is a legal entity that holds the pension investments and disburses the funds afterwards, when necessary.

Trusts are managed by trustees, who are independent of the company. We tin can examine several relationships below.

Relationship 1: Employees provide services to the employer and, in return, they receive wages.

Relationship 2: Employers make contributions to the alimony trust.

Relationship 3: Funds are used from the alimony trust to pay the employee in the future and, sometimes, employees tin can also make contributions to the trust.

To learn more than, launch our online accounting courses now!

2 Types of Pensions

In that location are two kinds of pensions available today. One is the defined contribution plan and the other is the defined benefits program. Below is a tabular comparison between the 2:

| Defined Contribution Plan | Divers Benefits Plan |

| This plan specifies how much money the employer needs to contribute to the pension plan. | This program specifies how much employees volition receive in payments during their retirement. |

| Investment risk is on the employees. | Investment hazard is on the employer. Outflows from the pension trust to employees are pre-specified. |

| Journal Entry: DR Pension Expense CR Cash | Journal Entry: More complicated. Explained below. |

To learn more than, launch our online accounting courses at present!

Defined Benefits Programme

Under the defined benefits plan, the employee is guaranteed a certain amount of benefits/payments in the hereafter. Because pension payments are usually made much later in the futurity, there is a clear fourth dimension deviation between when employees receive time to come payments and when employees really earn those benefits. Considering of this deviation, companies must utilize the accrual footing of accounting instead of when cash changes hand.

The pensions accounting treatment for divers do good plans requires:

- Determine the off-white value of the assets and liabilities of the alimony programme at the finish of the twelvemonth

- Decide the amount of alimony expense for the year to be reported on the income statement

- Value the net asset or liability position of the pension plan on a fair value footing

Pension expense is an expected value and when the bodily value of the pension differs, those deviations are recorded through other comprehensive income (OCI) under IFRS. For Canadian private companies that adhere to ASPE, there is no such OCI business relationship.

Pension Bookkeeping Example

XYZ Company has a defined benefit pension programme. At the end of 2015, the fair value of the assets and liabilities in the alimony amounted to $six million. In 2016, the alimony expense was $ten meg and the visitor contributed $v million to the pension programme. At the end of 2016, the off-white value of the pension assets and liabilities was $10 million. Allow's see how alimony accounting works.

To record visitor contribution to the pension

DR Divers Benefit Pension Liability five,000,000

CR Greenbacks 5,000,000

To tape pension expense

DR pension expense 10,000,000

CR Defined Benefit Pension Liability 10,000,000

To adjust alimony liability to fair value

DR Other comprehensive income (OCI) 1,000,000

CR Net divers benefit liability 1,000,000

To acquire more, launch our online accounting courses now!

Determining Pension Expense in Pension Accounting

At that place are four of import components that must exist considered when determining alimony expense:

- Current Service Cost: The increase in the present value of the pension obligation that results from the employees' current services

- Past Service Cost: These costs arise from plan initiations, programme amendments, and reductions in the number of employees under pension plans

- Interest Cost: The increase in the overall alimony obligation due to the passage of time

- Expected Income from Programme Assets: Income expected from assets in the alimony program, including investment income from interest, dividends, and capital gains

Accounting for Other Benefits

In addition to alimony bookkeeping, companies also have to provide other benefits that are treated similarly to pensions from an bookkeeping perspective.

For case, some companies keep to pay for medical services used by former employees who have retired. This is seen in several companies in the United States.

Similar to pension benefits, companies will accrue an expense for benefits earned by employees in that year and create a liability provision for those benefits that are to exist provided in the future.

Although the general thought may seem straightforward, there are several other factors that must be considered.

For example, dissimilar to pension payments, the costs of healthcare services may alter drastically over time and the use of these services is irregular compared to annuity payments like pensions.

Therefore, when accounting for other employee-related benefits, some may crave proper professional and subjective judgment depending on the state of affairs.

To learn more, launch our online accounting courses now!

Boosted Accounting Resources

This guide to pension accounting is a primer on some of the nuances of handling pensions and other benefits as an accountant. In order to help advance your career, we recommend these additional helpful CFI resources:

- Accounting Theory

- Goodwill Damage Bookkeeping

- Public Accounting Jobs

- All Accounting Manufactures

Source: https://corporatefinanceinstitute.com/resources/knowledge/accounting/pension-accounting/

0 Response to "Can You Collect Social Security and a Pension at the Same Time"

Post a Comment